Guest Lecture on Intrinsic Valuation of Stocks

On September 30, 2024, the Finance Club of the School of Management, GD Goenka University

hosted an exciting guest lecture focused on Financial Modeling for Intrinsic Stock Valuation.

About the Speaker:

The lecture was delivered by Mr. Gaurav Arora, Associate Director at Grant Thornton Bharat LLP. With over a decade of experience in finance and consulting, Mr. Arora is a seasoned professional known for his expertise in financial modeling, advanced Microsoft Excel, and high-impact organizational training programs.

About the lecture:

The lecture offered a practical, hands-on approach to developing industry-ready skills through continuous practice. Mr. Arora emphasized the importance of mastering any skill set one chooses to pursue. He introduced us to financial modeling, focusing on intrinsic company valuation and guiding us through essential calculations like Weighted Average Cost of Capital and projected future cash flows. The session was a rich blend of foundational principles and real-world applications.

Session Highlights:

Mr. Arora kicked off the session with a compelling analogy about driving: even with all the theoretical knowledge in the world, one cannot drive a car without practical experience on the road. Similarly, skills like Excel and financial modelling demand consistent practice.

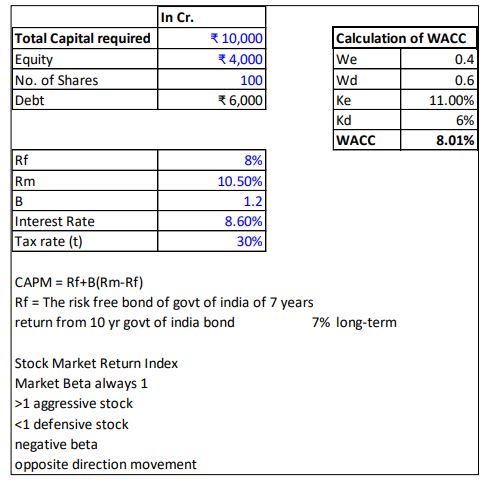

He began by explaining the colour coding in Excel: blue cells indicate manual input, black cells are automatically calculated, and green cells represent linked data. Mr. Arora then shared an Excel file containing an intrinsic valuation template. In the first spreadsheet, students calculated the Weighted Average Cost of Capital (WACC).

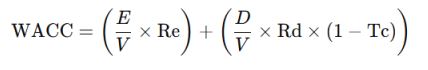

The formula for Weighted Average Cost of Capital (WACC) is:

Where:

- E = Market value of equity (total equity or stock value of the firm)

- D = Market value of debt (total debt value of the firm)

- V = E + D (total firm value, or combined market value of debt and equity)

- Re = Cost of equity (calculated using Capital Asset Pricing Model)

- Rd = Cost of debt (expected rate of return by debt holders or interest rate)

- Tc = Corporate tax rate

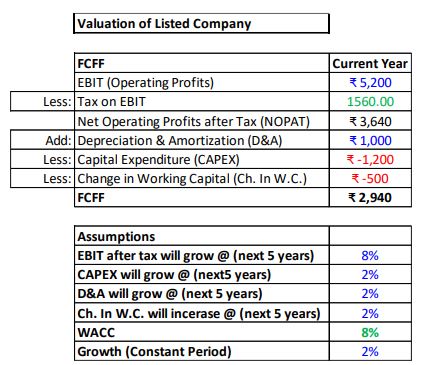

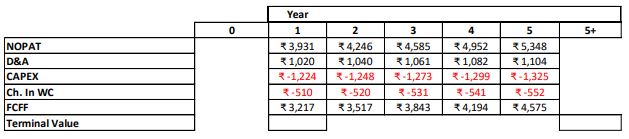

Mr. Arora provided the input values as seen above and the WACC came out to be 8.01%. On the 2nd screenshot we calculated the Free Cash Flow to Firm (FCFF) as follows:

Post Calculation of the FCFF, Mr. Arora helped us calculate Future Cash Flows using the growth assumptions as above for the respective line items below. Each subsequent Cash Flow was calculated by multiplying the previous cash flow by (1+ assumed growth rate in %). Unfortunately, since this was a simplified Financial Modelling template for beginners and as the session came to an end, topics of DCF and terminal value had to be adjourned for a future session.

The guest lecture on intrinsic valuation offered a valuable, hands-on look into industry practices. Mr. Gaurav Arora underscored the importance of consistent practice and skill development, particularly for students aspiring to enter the capital markets. His message resonated: "One can possess all the theoretical knowledge, but the real test lies in its practical application." Mr. Arora wrapped up the session by answering student questions and left them with an essential takeaway: to always be “BRILLIANT WITH BASICS.”

Following the lecture, the Finance Club presented Mr. Arora with a token of appreciation for his insightful session. Students were energized by his expertise and enthusiasm and expressed eagerness for future sessions with him.

Our Blogs Similar Blogs

Connect with UsTalk to our Admissions Counsellor

+91 9910000062